Let’s be honest. The tech stack of a modern professional service firm—consultancy, agency, legal practice, you name it—looks less like a neat filing cabinet and more like a bustling city. You’ve got project management towers over here, CRM plazas there, time-tracking streetlights everywhere. And then, tucked away in its own district, is the accounting system. The problem? Too often, these districts don’t talk. The data taxis get stuck in traffic, causing delays, errors, and a whole lot of manual, soul-crushing reconciliation work.

That’s where accounting system integration comes in. It’s not just a “nice-to-have” tech project. For firms running on a suite of SaaS applications, it’s the underground hyperloop that connects your entire operation, making financial clarity not just possible, but automatic. Here’s the deal: when your tools talk, your business can walk—no, run—with confidence.

Why “Siloed” is a Four-Letter Word for Service Firms

Picture this. Your team logs hours in Harvest or ClickUp. Your project managers track budgets in Asana. Invoices go out from… well, maybe still from a manual PDF? And then, someone—probably you or a weary accountant—has to manually key all that data into QuickBooks Online, Xero, or NetSuite. It’s a recipe for disaster. A typo here, a missed entry there. Suddenly, your profit margin report is fiction, and cash flow forecasting feels like astrology.

The pain points are real, and they’re spectacularly inefficient:

- Wasted Billable Time: Every minute spent on manual data entry is a minute not spent on client work or strategy. That’s literal revenue walking out the door.

- Cash Flow Blindspots: If invoicing is delayed because time sheets haven’t been reconciled, you’re essentially giving clients an interest-free loan. Not a great business model.

- Decision Lag: Leadership can’t make agile decisions based on stale financials. Is that project profitable? Which service line is booming? Without integration, you’re guessing.

- Compliance Risk: Human error increases the risk of inaccurate books, leading to stressful audits and potential compliance headaches.

The Anatomy of a Connected Tech Stack

So, what does good look like? A truly integrated system creates a seamless, circular flow of data. Think of it as the circulatory system for your firm’s financial health.

The Core Data Flow

| From This App… | To Your Accounting System… | The Magic That Happens |

| Time & Project Management (e.g., Mavenlink, Kantata) | Auto-creates draft invoices, posts project costs | Revenue is recognized in real-time; project profitability is always clear. |

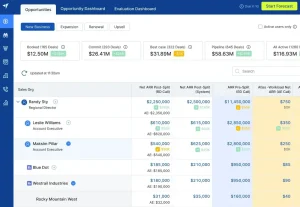

| CRM (e.g., Salesforce, HubSpot) | Syncs client data, tracks invoice status | Sales pipeline health is tied directly to realized revenue. No duplicate data entry for new clients. |

| Expense Management (e.g., Ramp, Expensify) | Feeds categorized expenses directly into the GL | Credit card reconciliations become a one-click affair. Mileage, receipts—all automated. |

| Payroll (e.g., Gusto, Rippling) | Posts salary allocations and employer taxes | Labor costs are accurately reflected without manual journal entries. It just… works. |

This isn’t science fiction. It’s the operational reality for firms that have decided to stop letting their software bully them. The result? Your accounting system becomes a single source of truth, fed by clean, automated data streams from every corner of your business.

Choosing Your Integration Path: Connectors vs. Platforms

Alright, you’re sold on the vision. But how do you actually build this? Well, you’ve got a couple of main routes, each with its own landscape.

The Point-to-Point Connector Route

This is the “DIY plumbing” approach. You use native integrations or tools like Zapier to connect App A to App B. It’s flexible and can be quick to set up for a single workflow.

Best for: Firms with a very simple, stable stack (think 3-4 core apps) and a high tolerance for maintaining multiple, separate connections. It can get messy, though—what developers call “spaghetti code”—if you try to connect too many things.

The Centralized Integration Platform Approach

This is the more robust, scalable highway system. Platforms like MuleSoft, Zapier (on a grand scale), or even industry-specific tools act as a central hub. Every app talks to the hub, and the hub manages all the data translation and routing.

Best for: Growing firms with complex, evolving tech stacks. It provides better oversight, easier troubleshooting, and is built to scale as you add more applications. Honestly, for most professional service firms aiming for serious growth, this is the path of least long-term resistance.

Implementation: It’s a Journey, Not a Flip of a Switch

Let’s not sugarcoat it. Even with the best tools, integration is a process. It requires thought. A successful rollout usually follows a rhythm:

- Map Your Current State: Literally, draw it. List every app, every piece of data that moves between them, and every manual process. You’ll find redundancies you didn’t even know existed.

- Clean Your Data First: Integrating messy data just automates mess. Standardize client names, project codes, and chart of accounts before you connect the pipes.

- Start with a High-Impact Pilot: Don’t boil the ocean. Connect your time-tracking to invoicing first. That one flow alone can free up dozens of hours and accelerate cash flow. See the win, then expand.

- Assign an Owner: This isn’t just an IT thing. Finance, operations, and department heads need a seat at the table. Someone needs to own the ongoing health of these connections.

The Tangible Payoff: Beyond Just Saving Time

Sure, the hours saved are glorious. But the real benefits are more… strategic. They’re the things that let you sleep at night and outmaneuver competitors.

Integrated systems give you real-time project profitability. You can see if a project is going off the rails financially while there’s still time to correct course. They enable accurate, predictive cash flow modeling because you have a live feed of upcoming invoices and expenses. They empower your team—project managers can see financials without needing a PhD in accounting, and leaders can make data-driven decisions without waiting for “month-end close.”

In fact, the shift is profound. Your finance function transforms from a historical record-keeper—a reporter of the past—into a strategic co-pilot, providing insights that shape the future.

Final Thoughts: The Integrated Firm as a Living Organism

For professional service firms, your intellectual capital and your time are your only inventory. An integrated SaaS tech stack, with your accounting system as its beating heart, is what ensures not a single drop of that value leaks out through the cracks of administrative chaos.

It’s about building a business that feels less like a collection of fragmented departments and more like a unified, intelligent organism. One that reacts, learns, and grows with a shared nervous system. The technology to do this is here, it’s mature, and it’s waiting. The only question left is how long you’re willing to tolerate the disconnect.